Background

That didn’t take long. Following a terrible start to the year, the markets came marching back to erase their February lows and stage advances toward a generally positive start to the year. Some hedge fund managers, however, succumbed to the dramatic churning that characterized the market in January and February. Citadel’s surveyor platform is reported to have unwound its entire book -- a decision that may have served to aggravate the markets even further.

The positions that suffered the most -- crowded hedge fund trades.

Symmetric.io has consistently tracked the nature and impact of trade crowding through each inflection point in the market. We illustrated the acute sensitivity of the high hedge fund ownership factor to the late summer 2015 selling pressure. The August market experienced similar convulsions as the opening of 2016, and our hypothesis entailed positions with a high concentration of hedge fund ownership as a percentage of the institutional float were under pressure. They were. They dramatically underperformed the market, but our findings also suggested that these positions may recover more quickly than the market.

The market turmoil in January and February of 2016 provided an opportunity to test the persistence of our observations. In our January report, we continued to see greater sensitivity to the market contractions among crowded hedge fund names.

Today, we revisit the findings of our prior report and shift the focus to crowdedness over time. Previously, we focused on managers and their relationship to the the Symmetric Hedge Fund Crowding Index. Now we will review how the crowdedness of hedge fund managers has changed over time.

We find evidence of increased crowding in two salient cases. First, crowding overall, over time has increased. Second, overlap between hedge funds overall and event-oriented funds has increased. Not only have hedge funds dramatically increased their exposure to hedge fund crowding, they increasingly intersect with some of the most volatile trades among hedge fund strategies.

Understanding hedge fund crowding is more important than ever.

The Symmetric Hedge Fund Crowding Index

The Symmetric Hedge Fund Crowding Index tracks positions in which hedge fund managers comprise a large percentage of the publicly traded float of the stock. By comparison, these positions are more likely to have their shares owned by hedge fund managers than other institutions.

The Symmetric Hedge Fund Crowding Index is particularly susceptible to movements when hedge funds trade as a group. If hedge funds are liquidating positions, their trading as a group may have an outsized impact on stocks in which they make up a large percent of ownership. The trading may be forced selling, for example, to reduce risk or otherwise.

We first isolate the stocks that have highest percentage of hedge fund ownership. Then, we narrow it to a list of fifty stocks that have over 5BN in publicly traded float. The resulting index is available for comparison against individual manager return streams and other indices through access to the premium functionality of Symmetric.io.

Hedge Fund Crowding -- The Symmetric Hedge Fund Crowding Index In Context

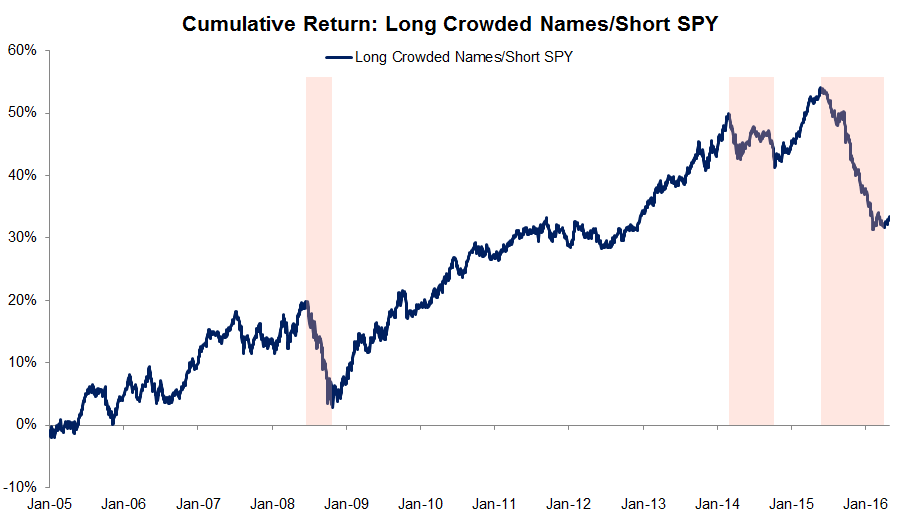

Our prior reports found that crowded hedge fund positions tend to outperform the market by about 3.5% a year. Crowded positions, however, tend to underperform during times of stress, so periods such as those in Q1 bring a dramatic pause to what has otherwise been an moderately alpha-bearing strategy. The current drawdown from peak of over 20% is substantially worse than the drawdowns that occurred historically.

As is illustrated in the chart, any recovery may be said to still be in its early phase and our crowded stock index is presently not outperforming the SPY. If we were to take past as prologue, however, we would expect similar outperformance among crowded names as we proceed through 2016. That said, the far more dramatic drawdown forces a question: has the nature of the hedge fund crowding factor evolved to elicit as large a drawdown as we experienced?

How Has Hedge Fund Crowding Changed Over Time?

Hedge fund crowding has typically been approached on a position-level basis. What are the crowded trades? How crowded are they? The Symmetric Hedge Fund Crowding Index does exactly this, but in order to put the current drawdown in context, one must compare the nature and exposure of the crowding factor over time.

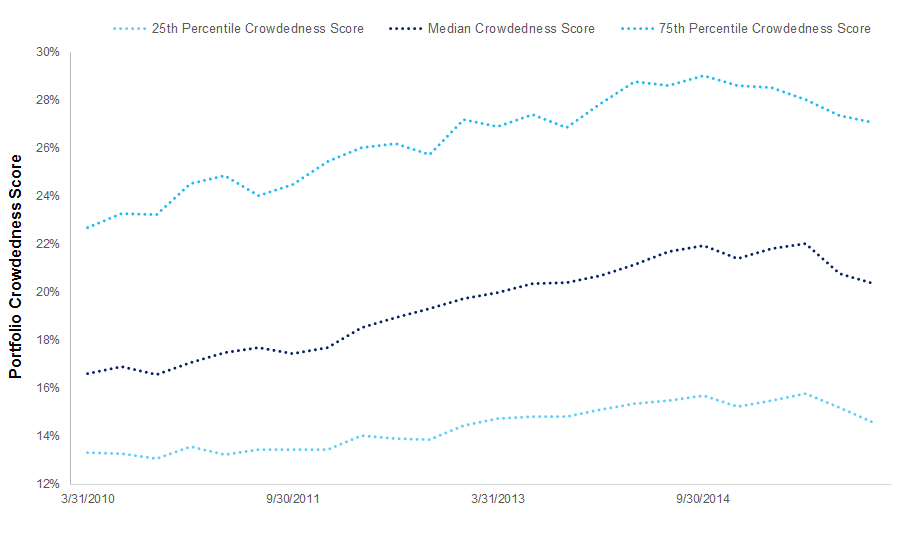

To do so, Symmetric analyzed how pervasive crowding is within the hedge fund universe at any given point in time. The resulting time-series illustrates increasing levels of hedge fund crowding over time.

We started with point-in-time data of hedge fund holdings to assess the level of crowding among hedge funds over time. Each stock in the Symmetric universe has a crowdedness score based the percentage of its institutional float owned by hedge funds at any given point in time. Symmetric calculates the point in time crowding of each manager’s portfolio based on the crowding of each position-weighted exposure. We further divide managers according to percentile buckets (25th percentile, median, 75th percentile) at each point in time. The portfolio level crowdedness scores across the hedge fund universe shows a general increase in crowding among hedge fund portfolios over time.

Increased crowding among hedge fund managers is evident, but the source of the crowding is hard to pin down. With assets under management having increased dramatically from the lows of the financial crisis, it may be a symptom of managers straining against the capacity of their trades and compounded by a perhaps gregarious nature among managers.

Increasing Crowding has Corresponded with Increasing Overlap Between Unrelated Styles

Hedge fund managers will often shift from a single strategy to a multistrategy approach when they grow large enough. We asked, if something similar might also happen in the overall hedge fund universe. It has grown substantially since the crisis. Crowding has increased. Managers are working hard to source and exploit ideas. Are they looking outside their wheelhouse to other strategies?

We hypothesized that overlap across investment styles has grown within the hedge fund universe.

The data exhibit increased crowding of hedge fund positions over time. If managers are stepping outside of their expertise to pursue positions typically associated with other strategies, it would complicate crowding in a way that suggests some managers are relying on the conviction of others for some of their ideas. Rather than leading, more may be following.

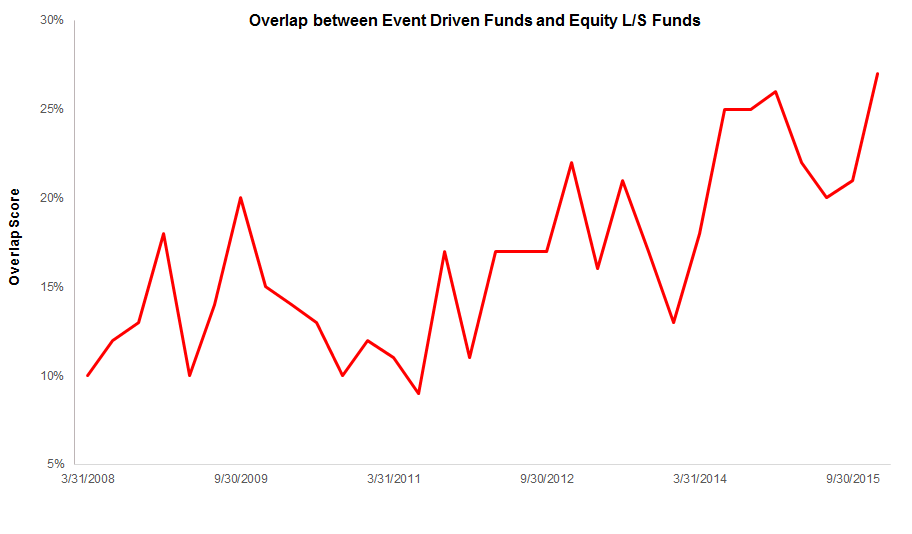

We start our analysis with event-oriented managers and compare these to those known more for their fundamental, long/short approach -- Tiger Cubs. Increasing crowdedness should correspond with increasing overlap between these typically unrelated styles.

We created an equal weighted portfolio of managers for event oriented and equity long/short managers (proxied by Tiger Cubs). We select the top one hundred positions for each portfolio at each point in time and calculate the number of positions that overlap between the two portfolios. If 25 positions overlap between the two portfolios, we calculate an overlap score as 25/100 = 25%.

Overlap has increased from close to ten percent to close to thirty percent since 2008. Equity long/short and event driven funds have been dabbling in each other’s positions and compounded the hedge fund crowding factor.

Conclusion

Understanding hedge fund crowding has become more important than ever. Increased Hedge fund crowding universally affected managers in the first quarter of 2016. The Symmetric Hedge Fund Crowding Index registered a dramatic downdraft through January and February that far exceeded those of crowding-related downturns in 2008 and 2014, but there is more to the story.

First, a point in time analysis indicated that hedge fund crowding has increased substantially over time. Second, overlap has also increased between differing styles -- fundamental long/short managers and event oriented managers, for example. These changes have corresponded with and explain increased sensitivity to hedge fund crowding, as illustrated by the performance of the Symmetric Hedge Fund Crowding Index.

It seems that hedge funds used to be snipers, picking out unique ideas. Now, they’re the cavalry, storming into ideas, with all the dust, chaos, and collisions you would expect.

Hedge fund crowding, once a source of returns, has now become a problem. Crowded hedge fund positions have historically outperformed the S&P, but growing crowdedness, overall, and overlap among differing styles has increased the volatility of the hedge fund crowding factor. If managers don’t manage their exposure to hedge fund crowding, they will encounter equal, if not more, brutal drawdowns in the future.