Jump to section:

Background

Symmetric provides the public reference-point for hedge fund investment skill. Some of the most sophisticated hedge fund allocators (hedge fund of funds, family offices, endowments) and financial advisors incorporate the analysis and rankings for due diligence and on-going monitoring of their hedge fund investments.

Many equity managers market themselves on their ability to pick individual stocks and are paid 2 and 20 for this skill, but it is often difficult to look at a hedge fund's overall returns and know how much of that came from stock picking.

Symmetric begins with a historical database of hedge fund holdings across a universe of more than one thousand funds. By observing how these holdings change and perform over time, we can assess the underlying skill of the investor and attribute it to their ability to pick stocks or sectors and size positions.

Symmetric's rankings are unique in the industry because they are based on isolating manager skill as opposed to returns. Overall hedge fund returns are driven by a number of factors including stock picking, sector picking, net long/short exposure, leverage, etc. All these factors drive returns, but managers are typically paid high fees of two-and-twenty for their stock picking skill.

Symmetric's rankings are the first in the industry to isolate stock picking skill and publicly rank hedge funds based upon that skill. The platform's analysis provides a framework to force-rank each hedge fund manager. The rankings illustrate the relative skill of equity long-short managers express, the most important of which is picking stocks.

The Quarterly Symmetric Stock Pickers Rankings recognizes those managers that are exceptional stock-pickers overall and by sector and the key investments themes that drive the industry. More importantly, it introduces the transparency with which ordinary investors can see the best possible publicly driven analysis of hedge fund decision-making and performance.

Methodology

Data

Symmetric begins with a historical database of hedge fund holdings across a universe of more than one thousand funds harvested from regulatory filings. Because hedge funds are required to file with the SEC, using regulatory filings to calculate rankings controls more effectively for survivorship bias compared to hedge fund analysis that depends upon self-reporting. By observing how these holdings change and perform over time, we can assess the underlying skill of the hedge fund and attribute it to their ability to pick individual stocks.

Measuring Stock Picking Skill

Stock picking skill measures a hedge fund manager's ability to pick stocks that outperform their corresponding sector. The commonly used Brinson-Fachler performance attribution methodology provides the foundation for the Symmetric approach. Intuitively, our approach is equivalent to calculating the performance of a portfolio in which each individual stock position is hedged with a sector index to create a market neutral and beta neutral portfolio. The return of that hedged portfolio corresponds to the manager's stock picking skill.

The rough intuition behind how this is calculated is as follows: let us assume that a hedge fund manager held GOOG stock for a quarter. If GOOG rallied 10% over that quarter at the same time as when the technology sector rallied 7%, much of that 10% return may have been coming from the sector. The manager in this instance picked a great sector, which is worth ~7%, but the manager's ability to pick stocks that outperform its peers is ~3% (10% minus 7%). We define stock selection skill as one's ability to pick a security that outperforms its sector.

To calculate stock picking skill, managers' long positions are first harvested from 13-F filings on a quarterly basis. The quarter-end sample forms the basis of a return-series that assumes the manager is able to trade in and out of the new and old positions at security prices at the end of each quarter. We calculate the return of the publicly disclosed portfolio and the resulting return series is called the "actual return of the publicly disclosed portfolio."

Next, we map each security in the publicly disclosed portfolio to a sector according to a standard industry mapping. We calculate the beta of each stock to its corresponding sector using daily price data with a one-year look-back. The betas adjust the exposure to each sector index required to hedge the individual stock. Based upon this mapping, we calculate the return of a "proxy portfolio" that captures how much of the "actual portfolios" returns come from the sectors that those stocks happened to be in.

The difference between the actual return of the publicly disclosed portfolio and the proxy portfolio each quarter is the stock selection skill of the manager for the quarter. The sum of the trailing four or twelve quarters, respectively, are the stock selection skill for the year or the past three years.

Key Positions

Stock picking skill provides Symmetric with a window on two drivers of hedge fund returns. First, it shows which stocks are driving stock picking skill for the top twenty stock-pickers. These are the stocks that contribute the most to the actual stock picking skill of the group since the release of the most recent quarterly filings. Ranked overall, Symmetric publishes the top-ten.

Symmetric also provides a view on what the top stock-pickers had been doing recently. These moves entail new positions, increased positions, and exited positions. The top-five positions for each category are calculated by looking at the top twenty stock-pickers and aggregating the top five of each.

These two views entail the key positions and recent activity sections in the Quarterly Symmetric Rankings

The Symmetric Twenty - Ranking the Top Skilled Investors

Stock Picking Skill Across the Hedge Fund universe

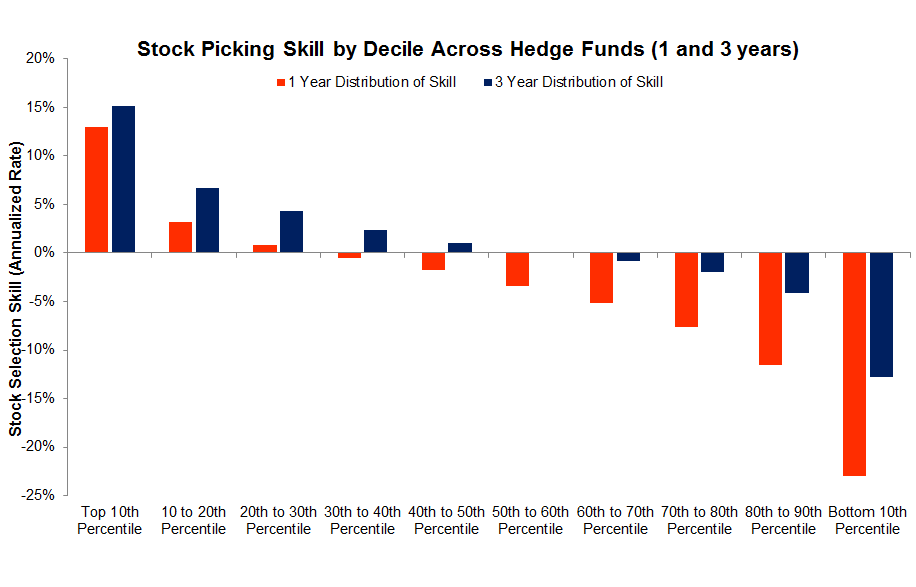

Stock picking is difficult. The distribution of stock picking skill shows that over the past three years only about half of managers have generated positive stock picking skill. Stock picking skill has been particularly hard to demonstrate over the past year. Over that period, only 30% of managers have demonstrated positive stock picking skill. The average manager over the last year has demonstrated negative stock picking skill

The Symmetric Twenty comprise the top twenty ranked long-short equity managers. We force-rank the entire Symmetric universe according to their realized stock-picking skill in the current quarter, 1 year back and three years back. The list is further adjusted to reflect those whose stock-picking skill reflects not only the greatest magnitude, but also the greatest consistency over each period. These rankings are calculated overall and for each of the underlying industry sector that hedge funds are invested in.

Overall Stock Picking Skill - 4th Quarter 2014 Symmetric Twenty

| Rank | 3yr Annualized Skill | Name | Founder | Reg AUM (MM) | % of Reg AUM covered by public portfolio |

|---|---|---|---|---|---|

| 1 | 16.2% | Whale Rock Capital Management | Alexander Sacerdote | 1,157 | 63% |

| 2 | 14.% | Matrix Capital Management | David Goel | 2,090 | 89% |

| 3 | 13.6% | Par Capital Management | Paul Reeder | 3,456 | >100% |

| 4 | 10.8% | Senator Investment Group | Alexander Klabin & Douglas Silverman | 10,943 | 83% |

| 5 | 10.5% | Starboard Value | Jeffrey Smith | 2,570 | 94% |

| 6 | 9.7% | Camber Capital Management | Stephen Dubois | 1,746 | 57% |

| 7 | 9.3% | Pershing Square Capital | William Ackman | 15,213 | 88% |

| 8 | 8.4% | Stieven Capital Advisors | Joseph Stieven | 284 | 94% |

| 9 | 7.9% | Steadfast Advisors | Robert Pitts | 8,168 | 69% |

| 10 | 7.2% | Redmile Group | Jeremy Green | 1,272 | 64% |

| 11 | 7.1% | Locust Wood Capital Advisers | Stephen Errico | 782 | 90% |

| 12 | 6.9% | Force Capital Management | Robert Jaffe | 1,188 | 51% |

| 13 | 6.9% | Stelliam Investment Managment | Ross Margolies | 3,508 | 99% |

| 14 | 6.7% | Valinor Management | David Gallo | 4,344 | 83% |

| 15 | 6.6% | V3 Capital Management | Charles Fitzgerald | 320 | 84% |

| 16 | 6.4% | Abrams Bison Investments | Gavin Abrams | 2,060 | 71% |

| 17 | 6.4% | Highfields Capital Management | Jonathon Jacobson | 22,705 | 55% |

| 18 | 5.7% | Passport Capital | John Burbank | 4,536 | 80% |

| 19 | 5.7% | Echo Street Capital Mgmt | Gregory Poole | 1,699 | >100% |

| 20 | 4.9% | Luminus Management | Jonathan Barret | 3,510 | 65% |

Technology Stock Picking Skill - 4th Qtr 2014 Symmetric Top 5

| Rank | 3yr Annualized Skill for Sector | Name | Founder | Reg AUM (MM) | % of Reg AUM covered by public portfolio |

|---|---|---|---|---|---|

| 1 | 20.% | Starboard Value | Jeffrey Smith | 2,570 | 94% |

| 2 | 13.% | Echo Street Capital Mgmt | Gregory Poole | 1,699 | >100% |

| 3 | 9.% | Lone Pine Capital | Stephen Mandel | 34,977 | 72% |

| 4 | 8.% | Blue Harbour Group | Clifton Robbins | 2,203 | >100% |

| 5 | 7.% | Akre Capital Management | Charles Akre | 3,204 | >100% |

Healthcare Stock Picking Skill - 4th Qtr 2014 Symmetric Top 5

| Rank | 3yr Annualized Skill for Sector | Name | Founder | Reg AUM (MM) | % of Reg AUM covered by public portfolio |

|---|---|---|---|---|---|

| 1 | 32.% | RA Capital Management | Peter Kolchinsky | 1,481 | 50% |

| 2 | 26.% | Pivot Point Capital Partners | Anthony Brenner | 246 | 99% |

| 3 | 16.% | Md Sass Investors Service | Martin Sass | 1,911 | 85% |

| 4 | 9.% | Camber Capital Management | Stephen Dubois | 1,746 | 57% |

| 5 | 8.% | Redmile Group | Jeremy Green | 1,272 | 64% |

Symmetric Rankings - Key Positions

Stock Picking Skill Across the Hedge Fund universe

Each stock picker owes their success to their underlying positions. We looked at the key positions that have driven their stock-picking success since Sept 30, 2014. These are organized according to the top 10 positions that contributed the most in aggregate to the stock-picking skill of the top twenty stock-pickers from Sept 30th 2014 to present. These are the winners that helped pushed the Symmetric Twenty forward most recently.

Symmetric Twenty's Top Ten Most Profitable Bets 4th Qtr 2014

| Rank | Ticker | Name of Stock | Fund(s) | Average Position Size | 4Q14 Return of Stock vs. Sector |

|---|---|---|---|---|---|

| 1 | YHOO | Yahoo! | Passport, Starboard | 11% | 23% |

| 2 | AGN | Allergan | Highfields, Pershing, Steadfast, Senator | 12% | 6% |

| 3 | ODP | Office Depot | Starboard | 10% | 28% |

| 4 | LB | L Brands | Abrams | 23% | 12% |

| 5 | BABA | Alibaba Group | Highfields, Steadfast, Whale-Rock, Senator, Passport | 2% | 26% |

| 6 | VIPS | Vipshop Holdings | Whale-Rock, Passport | 5% | 26% |

| 7 | CLDT | Chatham Lodging Trust | V3 | 19% | 11% |

| 8 | RCPT | Receptos | Redmile | 3% | 66% |

| 9 | IMPV | Imperva | Whale-Rock | 4% | 50% |

| 10 | DAL | Delta Air Lines | Par, Stelliam, Senator | 5% | 15% |

Symmetric Rankings - Recent Activity

What have the Skilled Investors been doing?

Skilled investors separate themselves from the hedge fund universe through their stock-picks. Unlike the picks of the universe overall, these picks are those that drive the top performers. We highlighted the positions skilled investors initiated, accumulated and exited recently.

Symmetric Twenty's The Top Five Recent New Positions

| Rank | Ticker | Name of Stock | Fund(s) | Average Position Size | 4Q14 Return of Stock vs. Sector |

|---|---|---|---|---|---|

| 1 | LB | L Brands Inc | Abrams | 23% | 12% |

| 2 | YHOO | Yahoo! Inc | Starboard | 13% | 23% |

| 3 | NSAM | Northstar Asset | Locust, Steadfast, V3 | 3% | 11% |

| 4 | BABA | Alibaba Group | Highfields, Steadfast, Whale-Rock, Senator, Passport | 2% | 26% |

| 5 | LBTYK | Liberty Global | Locust, Steadfast, Passport | 2% | 8% |

Symmetric Twenty's Top Five Recent Increased Positions

| Rank | Ticker | Name of Stock | Fund(s) | Average Increase in Position Size | 4Q14 Return of Stock vs. Sector |

|---|---|---|---|---|---|

| 1 | YHOO | Yahoo! Inc | Passport | 8% | 23% |

| 2 | KMX | Carmax Inc | Abrams | 5% | 16% |

| 3 | DATA | Tableau Software | Matrix, Whale-Rock | 2% | 12% |

| 4 | DLTR | Dollar Tree | Highfields, Stelliam | 2% | 7% |

| 5 | EVHC | Envision Healthcare | Valinor | 4% | -11% |

Symmetric Twenty's Top Five Closed Positions

| Rank | Ticker | Name of Stock | Fund(s) | Average Position Size Before Exit | 4Q14 Return of Stock vs. Sector |

|---|---|---|---|---|---|

| 1 | TRIP | Tripadvisor Inc | Whale-Rock, Steadfast | 5% | -27% |

| 2 | QIHU | Qihoo 360 | Whale-Rock | 8% | 4% |

| 3 | H | Hyatt Hotels | V3, Echo | 3% | -7% |

| 4 | WLP | Wellpoint Inc | Camber | 6% | % |

| 5 | SRC | Spirit Realty Capital | V3 | 5% | % |