Jump to section:

Background

Symmetric provides the public reference-point for hedge fund investment skill. Some of the most sophisticated hedge fund allocators (hedge fund of funds, family offices, endowments) and financial advisors incorporate the analysis and rankings for due diligence and on-going monitoring of their hedge fund investments.

Many equity managers market themselves on their ability to pick individual stocks and are paid 2 and 20 for this skill, but it is often difficult to look at a hedge fund's overall returns and know how much of that came from stock picking.

Symmetric begins with a historical database of hedge fund holdings across a universe of more than one thousand funds. By observing how these holdings change and perform over time, we can assess the underlying skill of the investor and attribute it to their ability to pick stocks or sectors and size positions.

Symmetric's rankings are unique in the industry because they are based on isolating manager skill as opposed to returns. Overall hedge fund returns are driven by a number of factors including stock picking, sector picking, net long/short exposure, leverage, etc. All these factors drive returns, but managers are typically paid high fees of two-and-twenty for their stock picking skill or StockAlpha.

Symmetric's rankings are the first in the industry to isolate stock picking alpha and publicly rank hedge funds based upon that metric. The platform's analysis provides a framework to force-rank each hedge fund manager. The rankings illustrate the relative skill of equity long-short managers express, the most important of which is picking stocks.

The Quarterly Symmetric Stock Pickers Rankings recognizes those managers that are exceptional stock-pickers overall and by sector and the key investments themes that drive the industry. More importantly, it introduces the transparency with which ordinary investors can see the best possible publicly driven analysis of hedge fund decision-making and performance.

Methodology

Data

Symmetric begins with a historical database of hedge fund holdings across a universe of more than one thousand funds harvested from regulatory filings. Because hedge funds are required to file with the SEC, using regulatory filings to calculate rankings controls more effectively for survivorship bias compared to hedge fund analysis that depends upon self-reporting. By observing how these holdings change and perform over time, we can assess the underlying skill of the hedge fund and attribute it to their ability to pick individual stocks.

Measuring StockAlpha

StockAlpha measures a hedge fund manager's ability to pick stocks that outperform their corresponding sector. The commonly used Brinson-Fachler performance attribution methodology provides the foundation for the Symmetric approach. Intuitively, our approach is equivalent to calculating the performance of a portfolio in which each individual stock position is hedged with a sector index to create a market neutral and beta neutral portfolio. The return of that hedged portfolio corresponds to the manager's stock picking skill and is what we call StockAlpha.

The rough intuition behind how this is calculated is as follows: let us assume that a hedge fund manager held Apple stock for a quarter. If Apple rallied 10% over that quarter at the same time as when the technology sector rallied 7%, much of that 10% return may have been coming from the sector. The manager in this instance picked a great sector, which is worth ~7%, but the manager's ability to pick stocks that outperform its peers is ~3% (10% minus 7%). We define StockAlpha as one's ability to pick a security that outperforms its sector.

To calculate StockAlpha, a managers' long positions are first harvested from 13-F filings on a quarterly basis. The quarter-end sample forms the basis of a return-series that assumes the manager is able to trade in and out of the new and old positions at security prices at the end of each quarter. We calculate the return of the publicly disclosed portfolio and the resulting return series is called the "actual return of the publicly disclosed portfolio."

Next, we map each security in the publicly disclosed portfolio to a sector according to a standard industry mapping. We calculate the beta of each stock to its corresponding sector using daily price data with a one-year look-back. The betas adjust the exposure to each sector index required to hedge the individual stock. Based upon this mapping, we calculate the return of a "proxy portfolio" that captures how much of the "actual portfolios" returns come from the sectors that those stocks happened to be in.

The difference between the actual return of the publicly disclosed portfolio and the proxy portfolio each quarter is the StockAlpha of the manager for the quarter. The sum of the trailing four or twelve quarters, respectively, are the StockAlpha for the year or the past three years.

The Symmetric Twenty - Ranking the Top Skilled Investors

StockAlpha Across the Hedge Fund universe

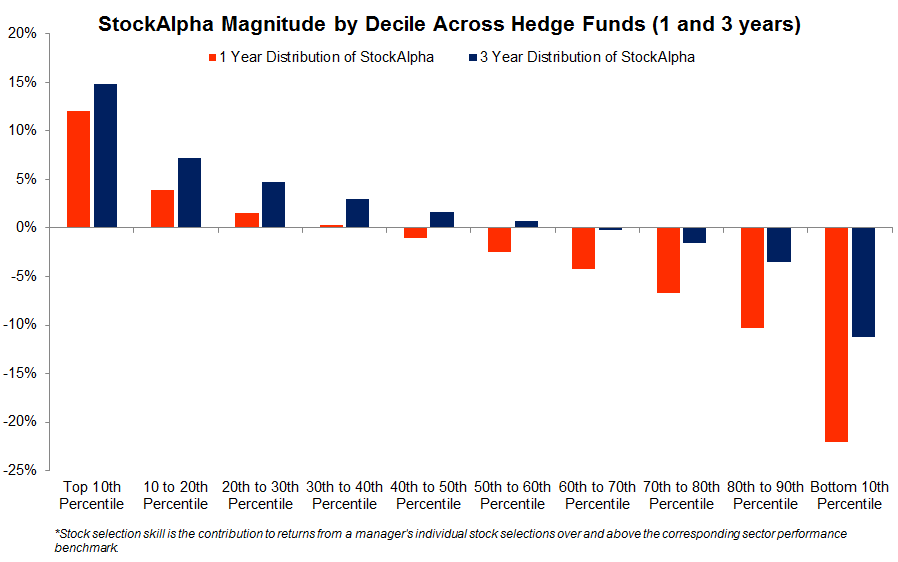

Stock picking is difficult. The distribution of StockAlpha shows that over the past three years just over half of managers have generated positive stock picking skill. StockAlpha has improved over the past quarter, though. For the trailing twelve months, 40% of managers have demonstrated positive StockAlpha; this means that only 40% of managers were able to pick stocks that outperformed their sectors. But this is a meaningful improvement from our previous report, in which only 20% had delivered positive StockAlpha over the previous twelve months. Nonetheless, the average manager over the last year has demonstrated negative StockAlpha.

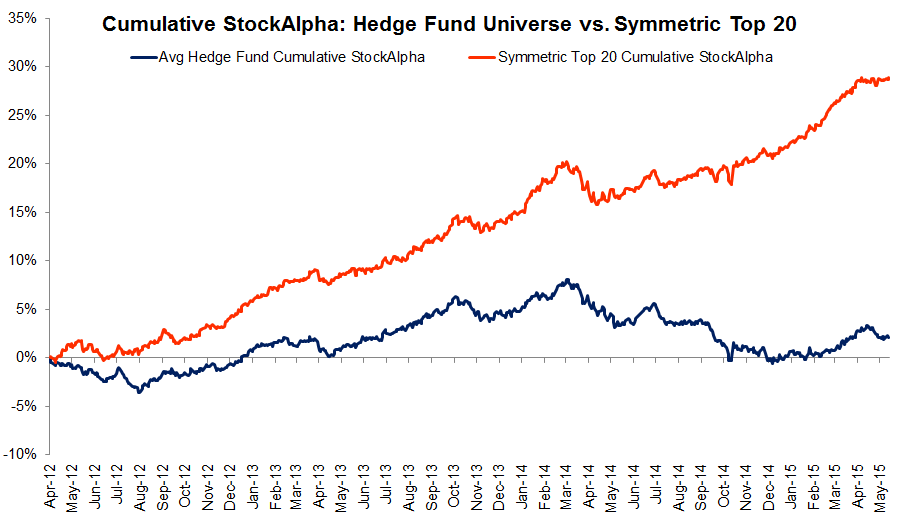

Symmetric Top 20 Cumulative StockAlpha vs. HF universe Cumulative StockAlpha

The Symmetric Twenty comprise the top twenty ranked long-short equity managers. We force-rank the entire Symmetric universe according to their realized StockAlpha year to date, 12 months back and three years back. The list is further adjusted to reflect those whose StockAlpha has not only the greatest magnitude, but also the greatest consistency over each period.

The following chart shows the cumulative StockAlpha for the Symmetric Top 20 vs. cumulative StockAlpha for the entire hedge fund universe. The chart demonstrates the magnitude of dispersion between the best and most consistent stock pickers and the average stock pickers. The Symmetric Top 20 have added over 25% of StockAlpha above the average hedge fund over the past 3 years or roughly 8% a year. With hedge fund fees typically being around 2% of assets and managed and 20% of profits, its clear that only the very top stock pickers are worth paying for. The average hedge fund would return negative StockAlpha after fees.

Overall StockAlpha - 2nd Quarter 2015 Symmetric Twenty

| Name | Founder | 3 Yr StockAlpha Magnitude | 3 Yr StockAlpha Sharpe |

|---|---|---|---|

| Broadfin Capital Llc | Kevin Kotler | 21.86% | 1.05 |

| Brave Warrior Advisors Llc | Glenn Greenberg | 18.19% | 2.29 |

| Hound Partners Llc | Jonathan Auerbach | 14.96% | 2.08 |

| Matrix Capital Management | David E. Goel | 11.64% | 1.24 |

| Valueact Holdings Lp | Jeffrey W. Ubben | 10.9% | 1.71 |

| Pershing Square Capital Mgmt | William Ackman | 10.32% | 1.15 |

| Abrams Bison Investments Llc | Gavin Abrams | 10.24% | 1.43 |

| Senator Investment Group Lp | Alexander Klabin & Douglas Silverman | 10.15% | 2.71 |

| V3 Capital Management Lp | Charles Fitzgerald & Justin F. Meng | 9.81% | 1.01 |

| Scopia Management Inc | Jeremy Mindich | 9.49% | .97 |

| Dorsal Capital Mgmt Llc | Ryan Frick | 9.47% | .98 |

| Brenner West Capital Advisors | Craig Nerenberg & Joshua W. Kaufman | 9.41% | 1.38 |

| Steadfast Capital Mgmt Llc | Robert Pitts | 9.36% | 1.95 |

| Corvex Management Lp | Keith Meister | 8.79% | .99 |

| Locust Wood Capital Advisers Ll | Stephen Errico | 8.06% | 1.86 |

| Tremblant Capital Group | Brett Barakett | 6.58% | .96 |

| Southpoint Capital Advisors Lp | John Clark | 6.12% | 1.25 |

| Echo Street Capital Mgmt Llc | Gregory Poole | 4.77% | 1.01 |

| Magellan Asset Management Ltd | Hamish Douglass | 4.09% | 1.16 |

| Akre Capital Management | Charles Akre | 3.9% | 1.03 |

Key Highlights - 2nd Qtr 2015 vs. 1st Qtr 2015

Funds entering the list:

Brave Warrior: Helped by 35% position in VRX (up 13% since March 31st) and 8% position in MSFT (up 19% since March 31st)

Valueact: Helped by 21% position in VRX (up 13% since March 31st) and 16% position in MSFT (up 19% since March 31st)

Broadfin: Helped by 15% position in HZNP (up 125% YTD) and 5% position in RTRX (up 114% YTD)

Funds exiting the list:

Soroban: Hurt by 3% position in AXLL (down 22% since March 31st), but still has positive StockAlpha YTD

Starboard: Hurt by 25% position in DRI (down 7% since March 31st)

Valinor: Hurt by 6% position in LC (down 31% YTD)

A few of the several funds on the list for multiple quarters:

Locust Wood: Helped by 7% position in VRX (up 13% since March 31st) and 3% position in YUM (up 19% since March 31st)

Senator: Helped by 1% position in PBR (up 68% since March 31st)

Hound: Helped by 13% position in VRX (up 13% since March 31st)

Symmetric Rankings - Key Positions

StockAlpha Across the Hedge Fund universe

Each stock picker owes their success to their underlying positions. We looked at the key positions that have driven their stock-picking success since March 31st, 2015. These are organized according to the top 5 positions that contributed the most in aggregate to the StockAlpha of the top twenty stock-pickers from Mar 31st, 2015 to present. These are the winners that helped pushed the Symmetric Twenty forward most recently.

Symmetric Twenty's Top Five Most Profitable Bets 2nd Qtr 2015

| Rank | Ticker | Name of Stock | Fund(s) | Average Position Size | 2Q15 Return of Stock vs. Sector |

|---|---|---|---|---|---|

| 1 | VRX | Valeant Pharmaceuticals International Inc (ONT) | Brave, Brenner, Hound, Locust, Pershing, Steadfast, Valueact | 18% | 11% |

| 2 | NFLX | Netflix Inc | Matrix | 12% | 46% |

| 3 | MSFT | Microsoft Corp. | Brave, Dorsal, Magellan, Steadfast, Valueact | 8% | 14% |

| 4 | YUM | Yum! Brands Inc | Corvex, Locust, Magellan, Senator | 3% | 18% |

| 5 | DATA | Tableau Software Inc. | Dorsal, Matrix | 8% | 14% |

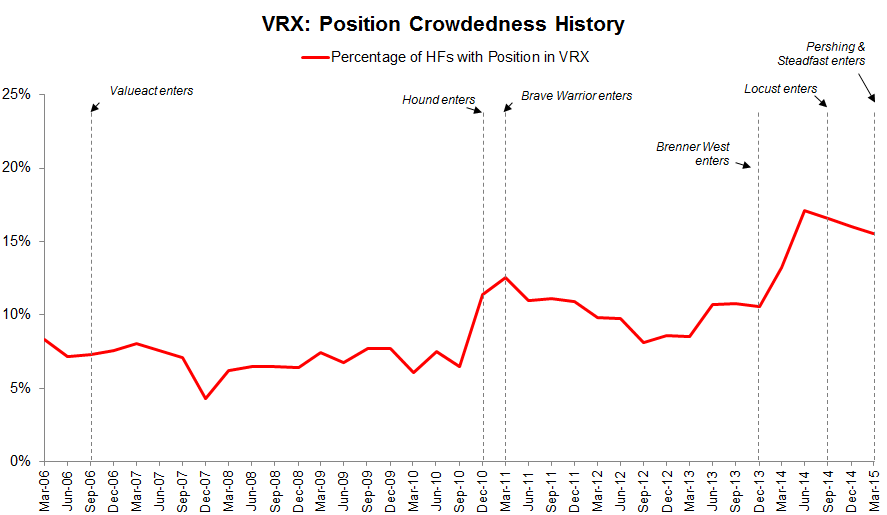

Investors holding a basket of hedge funds can often end up with exposure to just a few key bets. Of particular note on the list is VRX (Valeant Pharmaceuticals) which is currently owned by 7 of the Symmetric Top 20 and has driven a sizable portfolio of the alpha generated by the Symmetric Top 20. Symmetric's position overlap and portfolio monitoring shows who is relatively early to an idea vs. those who came later. The chart below shows the popularity of VRX amongst hedge funds over the past 10 years and shows when members of the Symmetric Top 20 initiated a new position in the trade.

Symmetric Rankings - Recent Activity

What have the Skilled Investors been doing?

Skilled investors separate themselves from the hedge fund universe through their stock-picks. Unlike the picks of the universe overall, these picks are those that drive the top performers. We highlighted the positions skilled investors initiated, accumulated and exited recently.

Symmetric Twenty's The Top Five Recent New Positions

| Rank | Ticker | Name of Stock | Fund(s) | Average Position Size | 2Q15 Return of Stock vs. Sector |

|---|---|---|---|---|---|

| 1 | VRX | Valeant Pharmaceuticals International Inc (ONT) | Pershing, Steadfast | 14% | 11% |

| 2 | KRFT | Kraft Foods Group Inc. | Hound, Senator, Southpoint | 4% | -3% |

| 3 | TCO | Taubman Centers Inc. | V3 | 11% | -3% |

| 4 | PLD | ProLogis Inc. | V3 | 8% | -9% |

| 5 | IBM | International Business Machines | Magellan | 7% | 4% |

Symmetric Twenty's Top Five Recent Increased Positions

| Rank | Ticker | Name of Stock | Fund(s) | Average Increase in Position Size | 2Q15 Return of Stock vs. Sector |

|---|---|---|---|---|---|

| 1 | V | VISA Inc | Akre, Echo, Magellan, Steadfast | 3% | 2% |

| 2 | ARCP | American Realty Capital Properties Inc. | Corvex | 8% | -10% |

| 3 | ACT | Actavis Plc | Corvex, Locust, Pershing, Senator, Steadfast | 4% | -3% |

| 4 | HAL | Halliburton Co. | Brave, Valueact | 3% | 2% |

| 5 | VRX | Valeant Pharmaceuticals International Inc (ONT) | Locust, Hound | 2% | 11% |

Symmetric Rankings - Activists

Activist Investors continue to add value vs the Hedge Fund Universe

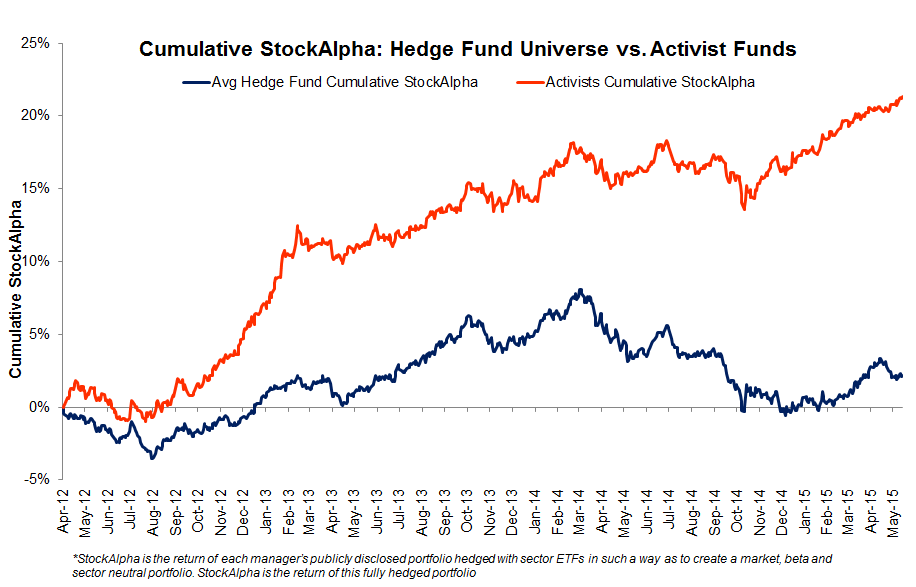

Activist investors continue to deliver StockAlpha that far exceeds the average hedge fund manager. Of the Symmetric Top 20, 4 were activist funds. Activists are not industry-specialists, but their stock-picks have outperformed the corresponding sectors. The chart below cumulative StockAlpha of a basket of 15 activist funds vs. the cumulative StockAlpha of the average hedge fund. The basket consists of the 4 activists that made the Symmetric Top 20 as well as other activists that did not make the cut this quarter including Starboard Value, Corvex, Jana Partners, amongst others.

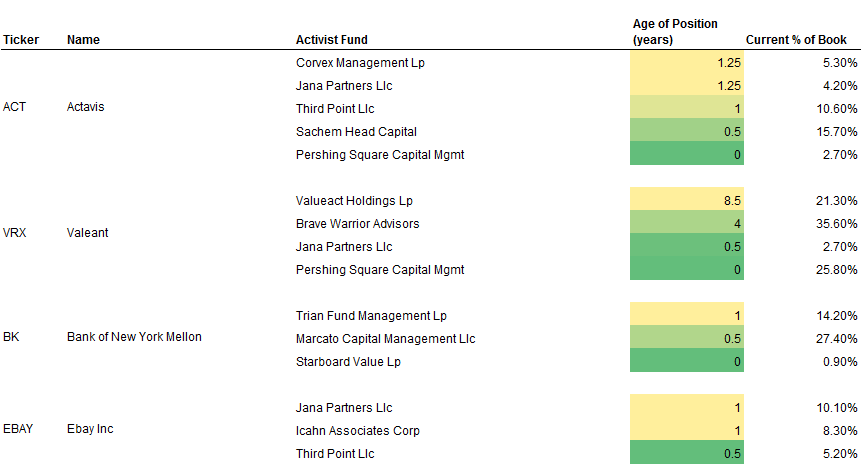

Activist Investors - Overlap

Many expect Activist Investors to overlap with one another. While this does happen, it is not as wide-spread as one might expect. When the Symmetric Activist Monitor does show overlap it's notable for two reasons. First, the timing of when they were initiated. One can see the manager that led the entrance into the position and distinguish them from the managers who come later. Second, the scale of the positions. Many of the overlapping positions share a common scale. The activist managers who enter alongside their peers do so according to a meaningful percentage of their publicly disclosed portfolio. When they follow, it is generally with high conviction.